|

|

|

What is the “option tax”?

The “option tax” in Stanley is an additional, local, sales tax of 2.5%. The full name would more correctly be the “local-option, nonproperty tax” as it is known in the Idaho Statutes. The State of Idaho wisely provides for such a tax for small cities (population less than 10,000) where a major portion of the business is derived from catering to recreational and other needs of people traveling through the area. What makes it an “option” is that the tax is a choice of the voters of the city to either have or not have such a tax.

The question is, "if the option tax is not approved at the election on November 3, 2015, what impact would it have on City Budgets?"

“The City Council has already considered the impacts of not reaffirming the option tax for Stanley on the budgets. It would have a very large and important impact on the services that the City normally provides for our community. Click on the link below to view the details of the budget impacts.”

Impact on the Budget

More information: Read the Statute that enables the option tax in the link below:

http://legislature.idaho.gov/idstat/Title50/T50CH10SECT50-1044.htm

Stanley option tax is of the sales tax type as found under item (c.) in the link below:

http://legislature.idaho.gov/idstat/Title50/T50CH10SECT50-1046.htm | | How does the Stanley option tax work?

It is an additional, local, sales tax on sales subject to taxation under chapter 36, title 63, of the Idaho Statutes. A good way to comprehend how the tax works is to review some examples:

If a person purchases a $20 tee shirt from a business in town, at the register they will be charged for the shirt, the state sales taxes, and an additional 50¢ for the Stanley option tax. The store owner turns over to the city the option taxes collected from the customers on their sales on a monthly basis.

If a person stays a couple of nights in a lodging establishment in Stanley, and the rate for the lodging for the length of stay is $200, the establishment will collect the $200, plus state sales tax, plus state hotel and convention tax, plus $5 for the Stanley option tax. The owner of the establishment turns over to the city the option taxes collected on their sales on a monthly basis.

If the organizer of an event in Stanley sells $20,000 worth of tickets, they will also collect from the purchasers the state taxes and a corresponding total of $500 for the Stanley option tax that will be turned over to the city on a monthly basis.

If a person purchases fishing trip package that includes a licensed guide, river raft, fishing tackle, camping gear, food services, etc. for a price of $2000, the outfitter will collect the $2000, plus state taxes, but no Stanley option tax. This is because a package deal which includes personal, licensed, guiding services is a special case, specifically excluded in the Stanley Municipal Code (SMC) from having to collect and turn over the 2.5% option tax. This is the only case that is an exception to the requirement to collect option tax. | | Why is the option tax so important to Stanley?

The City of Stanley Comprehensive Plan has long identified maintaining the option tax as an important policy of the city. The Comprehensive Plan states “This tax is essential, for it allows the City of Stanley to collect revenue for its operation from visitors who use its services.” It is a major benefit to the community to be able to receive revenue from some of the thousands of people who pass through the city and use our services, park, and streets.

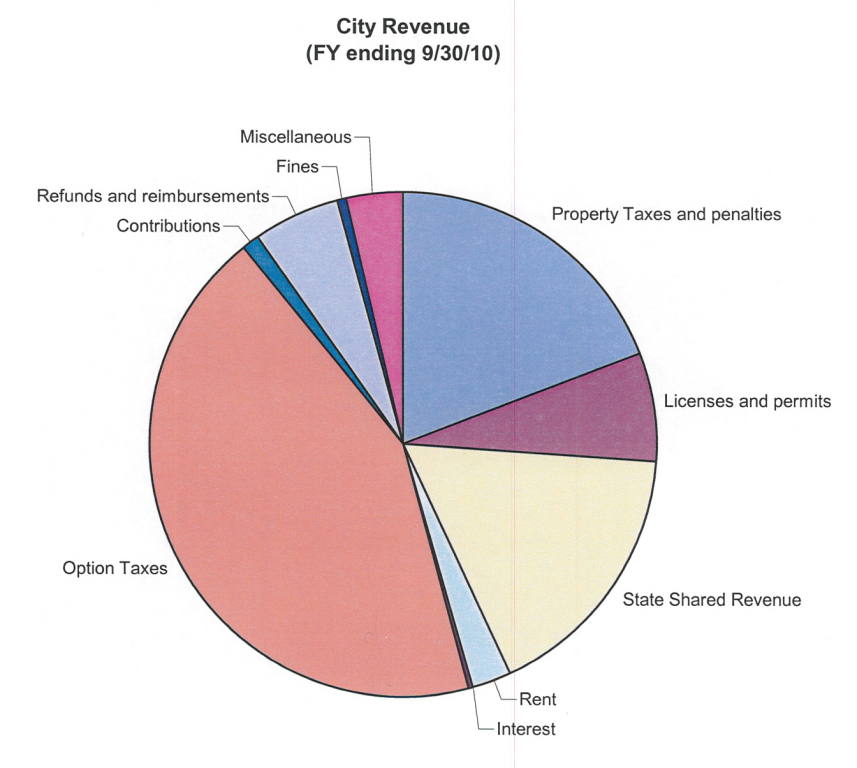

As you can see from the pie chart above and to the right, the option tax revenue is the most significant revenue source for the city (click on the image to enlarge it for viewing). It is almost half of all revenue received by the city and it is more than twice as large as any of the other sources of revenue.

If we did not have the option tax, the revenue would be cut almost in half requiring a corresponding reduction in the city budget. Particularly affected would be areas where the option tax is used: city park, cemetery, streets, snow grooming, law enforcement, and assistance for city-based organizations such as fire volunteers, emergency personnel, and the chamber of commerce.

The option tax gives the city another significant source of revenue so that the city is not entirely dependent on property taxes and a small amount of shared revenue from the state sales, highway, and liquor taxes.

Since the population and potential new home sites within the city limits of Stanley are very limited, the revenue from property taxes is quite small in comparison to the needs of a city with such high transient traffic for all those who come to enjoy our unique and beautiful area. Unlike most other small towns in Idaho or elsewhere, Stanley is severely limited in the ability to grow by extending the city limits. We are surrounded by federally owned lands with restrictions on development. |  | What is the option tax revenue used for?

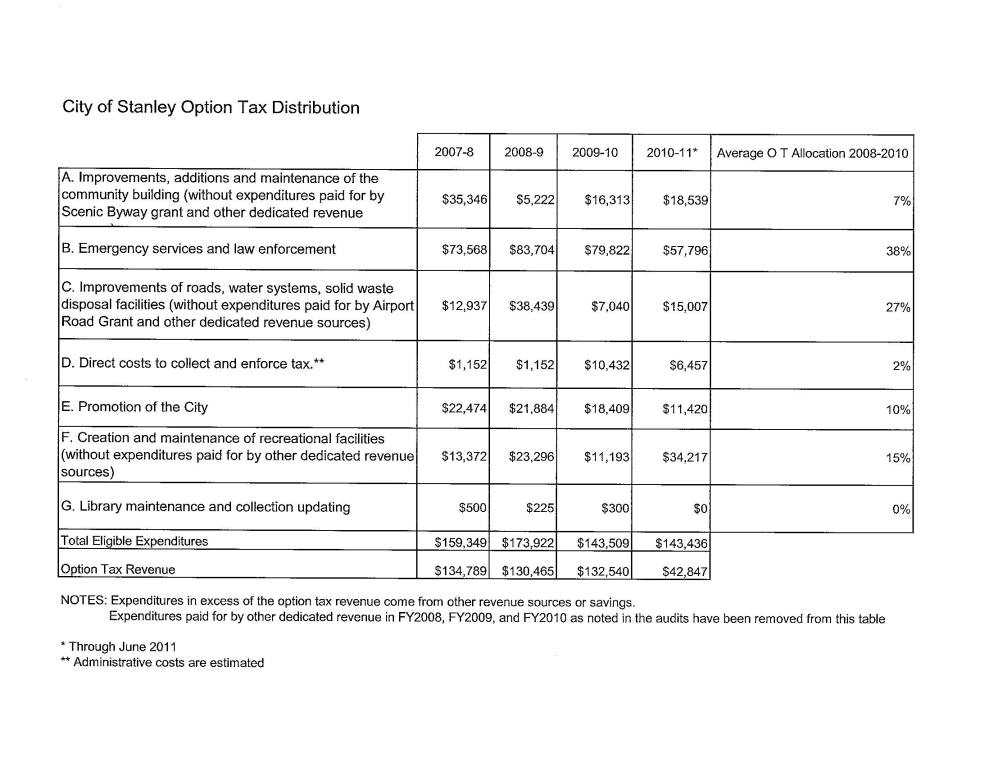

As voted in 2007, the funds obtained from the option tax are limited to the support of the City park, cemetery, streets, snow grooming, law enforcement, and city-based organizations such as fire volunteers, emergency personnel, chamber of commerce, and the library. City-based organizations use the “Option Tax Financial Support Request Form”, available in the city office, to be considered in the budget development and subsequent funds distribution process. Click on the image above and to the right to see how the opton tax revenue was distributed among the allowed uses in recent years.

When voted in 2011 the uses for the option tax were again specified. In addition to those listed above we added the possibility of using some of the funds as “matching funds” required for some grants which could benefit the community consistent with the Comprehensive Plan. In this way a small amount of matching funds may enable a much larger sum of money to be provided through a grant, thereby leveraging the funds for much greater benefit to the community. |  | Who pays the option tax?

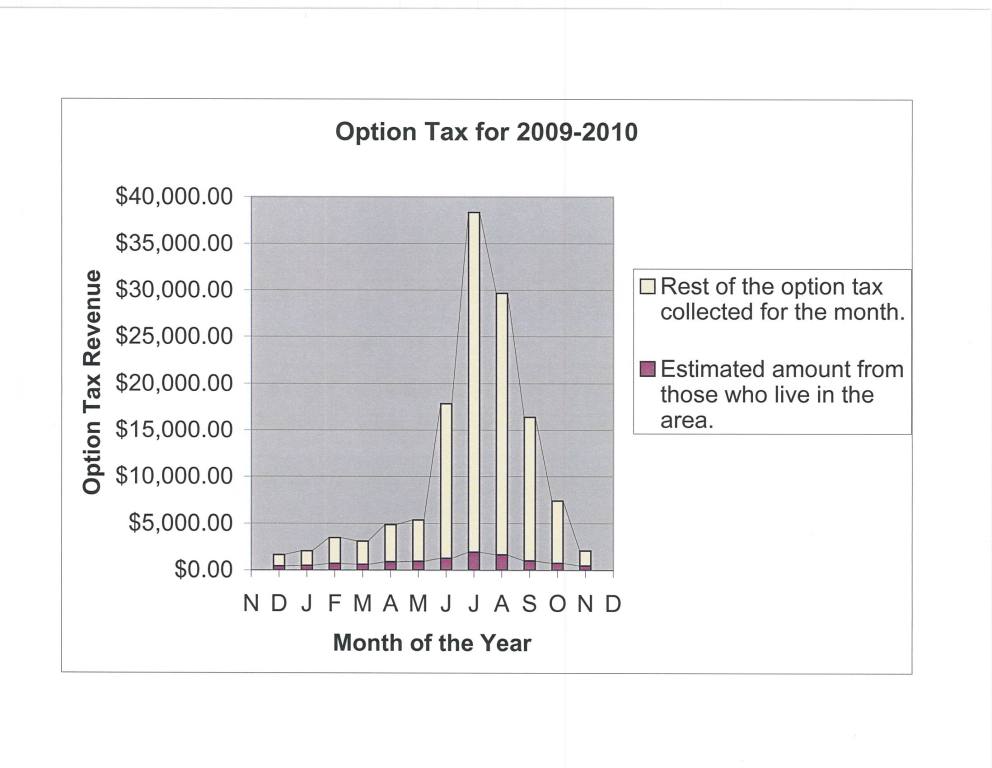

We all pay the option tax when we buy a taxable item within the city limits of Stanley. We pay an additional 2.5¢ per $1 of purchased goods or services. More importantly, any tourists, sportsmen, visitors, people passing through Stanley also pay the tax when making purchases in Stanley or purchasing tickets for an event in Stanley or pre-paying for goods or services in Stanley. It is this group of non-locals that provides the city the most revenue.

Locals provide a very small amount of the revenue, while the visitors to our resort community provide a substantially larger portion of the revenue. Click on the chart (above and to the right) to see the huge difference that the visitors make, to the benefit of our community, through the revenue generated by the option tax. |  | Has the option tax ordinace changed much over the last 25 years or so?

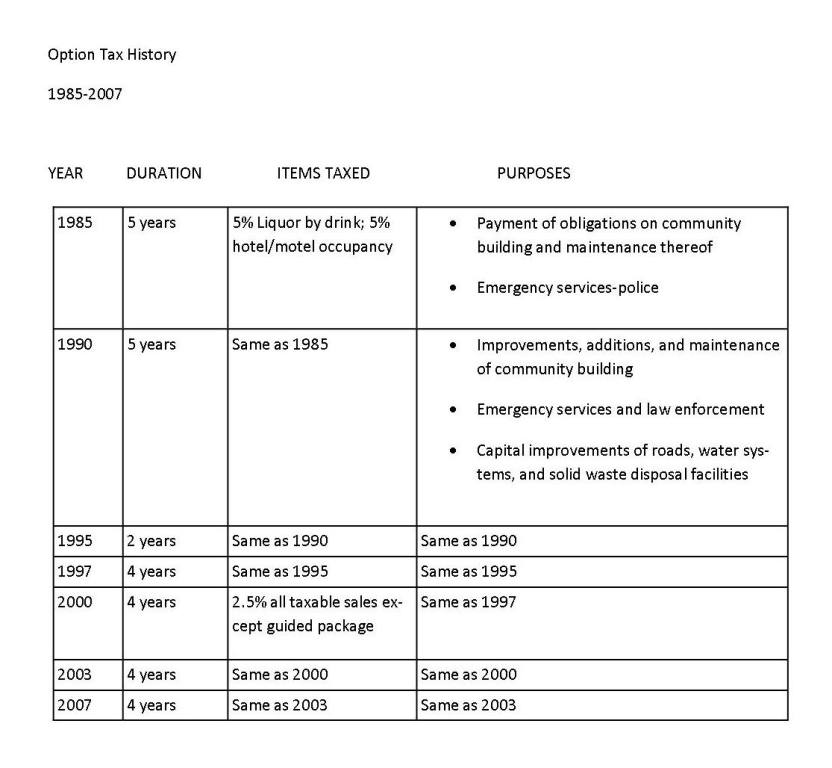

There have not been many changes in the purpose of the uses of the tax revenue, but there have been some important changes in the tax itself over the years. The tax was changed from 5% on liquor and lodging only to 2.5% general sales tax which proved to be more equitable for all Stanley businesses as well as raising more revenue. Also the time between reaffirmation votes on the option tax was changed from 5 years to 2 years at one point, then wisely changed back to a longer duration of 4 years. Click on the image above and to the right to see a summary of the change history. |  | If I sell tickets over the Internet for an event to be held in Stanley, do I have to collect option tax on those sales?

Very definitely, yes. It doesn't matter if your business is registered with a home address in Stanley or somewhere else. If the event takes place in Stanley you must collect the option tax on all sales which would be subject to Idaho state sales tax. This is true whether the sales take place over the Internet, through the U.S. Mail, at the gate, or however. The city requires this of any business entity that wants to have an event in Stanley where attendees are required to pay an admission. | | Is there a case where I would only have to charge option tax to those who live in Stanley, zip code 83278?

No, in fact this would be contrary to the very purpose of the option tax! Remember that the option tax is a source of revenue for the city that taxes (at a very small rate) tourists, visitors, and all purchasers of goods, services, and entertainment in Stanley. The idea is to share the cost of city service with those who come here to enjoy the area, not just those who live here. The number of our year round residents is very small, while the number of those passing through is very large. The option tax helps cover the cost of maintenance of our infrastructure without having to put that burden of cost on those few who live here. In no case is the option tax intended to penalize those who actually live here.

For more information, read the above questions and answers about what the option tax is and how it is important to Stanley. | | Are there penalties for not collecting or turning over the option tax to the city?

Yes, as with most taxes the penalties can be severe; however, almost all of our businesses in Stanley understand their responsibilities and regularly collect and turn over the tax money. Those who care for our community, understand the value and purpose of the option tax and willingly collect it, knowing what an important benefit it is to our city, and how it helps shift some of our burden of maintaining infrastructure and services to those who are just passing through. We much prefer working with good citizens who are willing to do the right thing, than having to take out the "big stick" to force them to do the right thing. You can be proud that in our community almost every one of our businesses in Stanley fall under this category of good citizens. | | I would like to have some vendors to sell food, drink, and maybe snacks (kettle corn, icecream) at my event in Stanley. Do the vendors have to collect the option tax?

Yes, the vendors are required to collect Idaho sales tax on their sales and also the city option tax. This is true whether or not the City Council requires the vendors to take out a temporary vendors permit for the event. If the City Council decides to waive the requirement for the temporary vendors permit for the event, option taxes must still be collected. Keep in mind, as the organizer of the event you will have more responsibility to be certain that vendors are properly informed of the tax requirements if the need for temporary vendors permits is waived by the City Council. | |

| |

|

|